Though it may be profitable, investing in crypto casinos calls for rigorous market knowledge and strategy. Whether you bet often or just recently, it’s crucial to understand the market.

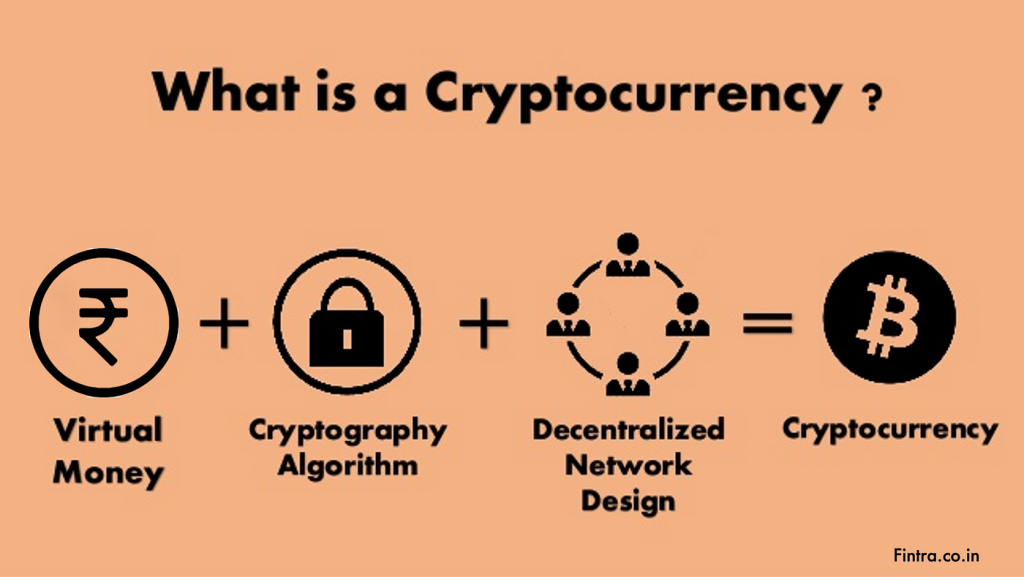

What is cryptocurrency?

Blockchain technology drives digital money produced from codes known as cryptocurrencies. Thanks to cryptographic technology, which guard transactions and manages the building of new units, they provide a great degree of security. Hugewin’s creative approach to gaming platforms makes use of cryptocurrencies to provide a quick, safe, open means of betting and payment collecting.

Types of cryptocurrencies

From well-known ones like Bitcoin and Ethereum to less-known substitutes, each with special qualities and use, there are several varieties of cryptocurrencies available on the market. With a range of cryptocurrencies in Hugewin’s portfolio, players may choose the greatest suit for their investment plans and playing approach.

What to consider before investing in cryptocurrency

Understanding the hazards and potential returns is essential when investing in cryptocurrencies. It is imperative to investigate technological advancements that could potentially influence the value of bitcoin, legal possibilities, and market volatility. The Hugewin staff recommends that users adhere to security protocols and utilize only reliable bitcoin trading platforms.

Is cryptocurrency a good investment?

Those looking for an opportunity to vary their investments and the prospect for big returns might find appeal in cryptocurrency for beginners. Still, like any other investment, it depends on a decent plan and market expertise. Hugewin provides tools and information to inform and choose the best investment choices in the sphere of cryptocurrencies, therefore benefiting its clients.

How to keep your cryptocurrency safe

Your belongings may be protected using two-factor authentication and reliable bitcoin wallets. Selecting trustworthy wallets with many degrees of security is crucial; cold wallets for long-term storage are one example. Hugewin counsels regular software updates and the use of complex unique passwords for additional protection.

How to invest in cryptocurrency in 2024

Investing in cryptocurrencies in 2024 will largely rely on carefully selecting companies with strong infrastructure and growth prospects. Investors should focus on cryptocurrencies with active communities, transparent government, and strong technical support. Hugewin underlines the significance of researching market trends and using many strategies to lower risk.

Step 1: Choose which cryptocurrency to invest in

Selecting a currency is the initial stage of crypto currency for beginners. Examining elements such as price volatility history, present market size, and technical development potential helps one choose cryptocurrencies with the greatest opportunities. Hugewin advises beginning with well-known cryptocurrencies like Bitcoin or Ethereum before looking into less-known but more recent options.

Step 2: Choose a cryptocurrency exchange

The security and effectiveness of your investment depend on your selecting a suitable bitcoin exchange. Search for exchanges with strong reputations providing minimal fees, great security, and a large selection of cryptocurrencies. Hugewin also advises giving the platform’s usability and customer support’s quality some thought, especially for those new to this field, using a beginners guide to crypto.

Step 3: Consider storage and digital wallet options

Protection of your cryptocurrency beginners depends on selecting the correct wallet. Digital wallets range in kind from cold wallets for long-term storage to hot wallets for regular transactions. Hugewin advises balancing security and ease by utilizing both kinds of wallets.

Step 4: Decide how much to invest

The amount of money you allocate to best crypto casinos for beginners should be determined by your overall investment budget and level of risk tolerance. Before making substantial investments, begin with a modest approach to gain a better understanding of the market. Hugewin emphasizes the importance of a prudent approach and cautions against investing more than one can afford to lose.

Step 5: Manage your investments

Managing your bitcoin assets calls for consistent market monitoring and adaptability to shifting circumstances. Analyze the results of your investments and make necessary changes. To keep on top of things, Hugewin counsels tracking changes in value utilizing automated tools and alerts of significant industry happenings.

Related Investments to Explore

Examining cryptocurrencies for beginners also makes one take into account related digital asset possibilities like digital stocks and stablecoins as well as non-fungible asset tokens (NFTs). Players on the Hugewin platform who search for innovation and new technologies in investing may find great interest in these instruments as they provide a range of investment portfolios.

Investing just got easier.

Starting an investment has grown simpler as technology develops and investment platforms’ availability rises. Hugewin and other platforms provide user interfaces that simplify purchasing, trading, and storing bitcoins, therefore opening a broad audience for these transactions.

Frequently asked questions about cryptocurrency investing

Although the bitcoin market might appear complex, the correct knowledge clarifies and simplifies the investing process.

What do I need to know before buying cryptocurrency?

Understanding the fundamentals of blockchain technology, the variations among the main cryptocurrencies, and the possible hazards of investment can let one acquire cryptocurrencies with knowledge. Crucially also is knowledge of your nation’s tax responsibilities and regulatory system.

What to look out for when investing in cryptocurrency

atform presents. Examining technical developments and market news that can influence the value of cryptocurrencies is equally crucial.

How much should a beginner invest in cryptocurrency?

It is recommended that novice investors begin with modest quantities that they are willing to risk, as the bitcoin market is notoriously volatile. Begin with a sum that would not significantly impact your financial well-being in the event of a loss. Hugewin offers investment management solutions that enable novices to gradually increase their funds as they gain more experience.